Welcome...kkk. to Buyabetterhome fgdfhgdfgdfgdfgdfgdf

Welcome...kkk. to Buyabetterhome fgdfhgdfgdfgdfgdfgdf

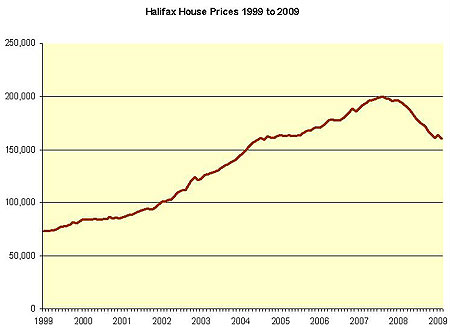

According to the Halifax, house prices slumped by a further 2.3% in February with the average house now being worth £160,327. This means that despite the bank showing a surprise 1.9% rise in January, house prices are now down 17.7% on the same time last year. The current average house price has now slipped back to August 2004 levels with £34,600 wiped of its value in twelve months. The bank’s chief economist Martin Ellis said: “Continuing pressures on incomes, rising unemployment and the negative impact of the dislocation of the financial markets on the availability of mortgage finance are, however, likely to mean that 2009 will be another difficult year for the housing market.”

Although estate agents have reported renewed interest from buyers, the large deposits now being demanded by mortgage lenders are preventing much of this interest actually turning into sales. As always, opinions are mixed as to how long the property slump will continue. Some agents are of the opinion that with property up to 20% cheaper than one year ago there is increased traction in the market and that it will pick up later this year. However, the impact of the recession and increasing job cuts has left most economists feeling pessimistic.

The Bank of England has cut the interest rate by a total of 1.5% (0.5% in January, February and March) already this year, leaving it at a mere 0.5% - the lowest it has ever been. If you’re lucky enough to be on tracker mortgage you will be reaping the full rewards, but borrowers on the lenders’ standard variable rates (SVR) might not be so lucky. The table below, courtesy of Moneyfacts names and shames the culprits who neglected to pass on the rate cuts in January and February.

Lender |

Standard variable rate |

Jan/Feb no cut |

No rate cut in February |

|

|

Chesham BS |

6.45 |

|

Newcastle BS |

5.99 |

no Jan cut |

Nottingham BS |

5.99 |

no Jan cut |

Kent Reliance BS |

5.98 |

no Jan cut |

Market Harborough BS |

5.95 |

|

West Bromwich BS |

5.84 |

no Jan cut |

Chelsea BS |

5.79 |

no Jan cut |

Hinckley & Rugby BS |

5.64 |

no Jan cut |

Shepshed BS |

5.54 |

no Jan cut |

Dunfermline BS |

5.49 |

no Jan cut |

Leeds BS |

5.49 |

no Jan cut |

Mansfield BS |

5.49 |

|

Marsden BS |

5.49 |

|

Scarborough BS |

5.49 |

|

Vernon BS |

5.49 |

|

Allied Irish Bank (GB) |

5.44 |

|

Furness BS |

5.44 |

|

Egg |

5.29 |

no Jan cut |

Monmouthshire BS |

5.25 |

|

Scottish BS |

5.24 |

|

Teachers BS |

5.19 |

|

Northern Bank (NI) |

5.05 |

|

Astra from N&P |

5 |

|

Norwich & Peterborough BS |

5 |

|

Barnsley BS |

4.99 |

|

Buckinghamshire BS |

4.99 |

|

First Trust Bank (NI) |

4.99 |

|

Hanley Economic BS |

4.99 |

|

Melton Mowbray BS |

4.99 |

|

Yorkshire BS |

4.99 |

|

Beverley BS |

4.95 |

|

Bank of Scotland Mortgages |

4.84 |

|

Birmingham Midshires Solutions |

4.84 |

|

Holmesdale BS |

4.84 |

|

Coventry BS |

4.74% (4.49 privilege rate) |

|

Accord Mortgages |

4.74 |

|

Abbey |

4.69 |

|

National Counties BS |

4.69 |

|

Ecology BS |

4.65 |

|

Bank of Ireland Mortgages |

3.99 |

|

Cumberland BS |

4.49 |

|

Giraffe Money |

3.99 |

|

Godiva Mortgages |

4.49 |

|

Ulster Bank (NI) |

4.17 |

|

The One Account |

4.1 |

|

Cambridge BS |

4 |

|

Coutts & Co |

4 |

|

Bristol & West Mortgages |

3.99 |

|

Scottish Widows Bank |

3.99 |

|

HSBC |

3.94 |

|

First Direct |

3.69 |

|

Bradford & Bingley |

3.64 |

|

No rate cut in January |

|

|

Darlington BS |

6.12 |

|

Dudley BS |

5.99 |

|

Newcastle BS |

5.99 |

no Feb cut |

Nottingham BS |

5.99 |

no Feb cut |

Kent Reliance BS |

5.98 |

no Feb cut |

Chorley & District BS |

5.85 |

|

West Bromwich BS |

5.84 |

no Feb cut |

Chelsea BS |

5.79 |

no Feb cut |

Ipswich BS |

5.75 |

|

Hinckley & Rugby BS |

5.64 |

no Feb cut |

Shepshed BS |

5.54 |

no Feb cut |

Dunfermline BS |

5.49 |

no Feb cut |

Leeds BS |

5.49 |

no Feb cut |

Saffron BS |

5.49 |

|

Woolwich |

5.49 |

|

Accord Mortgages |

5.34 |

no Feb cut |

Tipton & Coseley BS |

5.34 |

|

Egg |

5.29 |

no Feb cut |

Monmouthshire BS |

5.25 |

no Feb cut |

Barnsley BS |

4.99 |

no Feb cut |

Yorkshire BS |

4.99 |

no Feb cut |

Beverley BS |

4.95 |

no Feb cut |

Bank of Scotland Mortgages |

4.84 |

no Feb cut |

Birmingham Midshires Solutions |

4.84 |

no Feb cut |

The Co-operative Bank |

4.74 |

|

Newbury BS |

4.7 |

|

Ecology BS |

4.65 |

no Feb cut |

Cambridge BS |

4 |

no Feb cut |

Scottish Widows Bank |

3.99 |

no Feb cut |

Stafford Railway BS |

3.99 |

|

First Direct |

3.69 |

no Feb cut |

Lenders who had not cut rates after January and February 0.5% bank rate cuts by the day before the next Bank of England decision. Source: Moneyfacts |

||

|

||

Although it’s reassuring that the country’s biggest mortgage lenders have cut their rates, there are some famous names in the table. First Direct and Egg are perhaps the most notable names on the list that have not passed on the savings to its customers in either January or February. Some may say that in this time of financial crisis, the banks are showing their true colours.