Welcome...kkk. to Buyabetterhome fgdfhgdfgdfgdfgdfgdf

Welcome...kkk. to Buyabetterhome fgdfhgdfgdfgdfgdfgdf

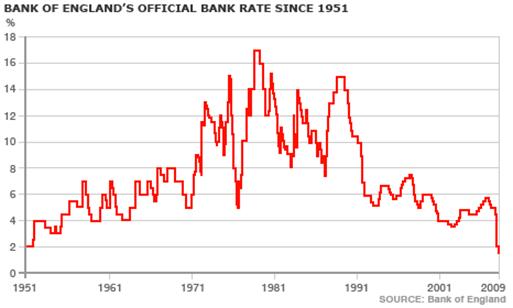

The Bank of England has cut the basic rate of interest once more as it continues its efforts to aid economic recovery. The latest reduction of 0.5% takes the base rate down to just 1.5% - the lowest level in the Bank of England’s 315 year history. This is the fifth time since October, when the base rate was at 5%, that the bank has reduced interest rates. The bank said that its main reasons for this decision was a prolonged contraction in business activity and the continued weakening of consumer spending.

This rate cut, although substantial by historical standards, is seen as a more cautious move after the major drops of November and December. Indeed it is widely believed that the Bank of England may now sit tight for a couple of months whilst it assesses the impact of these big cuts in the base rate. However, in some quarters, this latest cut was seen as not enough. The Manufacturers’ association EEF said that the move was “too timid” and Hetal Mehta, senior economist at Ernst & Young Item Club, said that although the move was “appropriate” – the bank should make further cuts. He went on to say that survey data confirms the fact that economic activity is “falling sharply” and that there was no reason why the Bank of England shouldn’t cut interest rates to “1% or below in the coming months”.

So how will the latest cut affect you if you are a mortgage holder? Once again, if you have a tracker mortgage you’ve got a very good chance of some good news. Ray Boulger, of independent mortgage brokers John Charcol, says that 93% of borrowers on a tracker mortgage will see the full benefit of the cut. To put that 0.5% interest rate cut into perspective; the average borrower with a £150,000 repayment mortgage will see payments drop by around £46 per month. HSBC and Halifax have both confirmed that they will pass the discount on to their customers in full. One Building Society who will not be passing on the rate cut to its tracker mortgage customers is Nationwide. It has a self-imposed collar of 2.75% and although it did pass on the last rate cut there will be no such relief this time for its 250,000 tracker mortgage customers.

If you have a mortgage on the standard variable rate (SVR) of interest it is also mostly good news. Cheltenham & Gloucester, Cheshire Building Society, Derbyshire Building Society, Lloyds TSB and Nationwide have all cut their SVR by 0.5% to 3.5%. Other cuts in SVR include Halifax (down 0.25% to 4.5%), HSBC (down 0.5% to 3.94%), NatWest (down 0.25% to 4.19%), RBS (down 0.25% to 4.19%) and Skipton Building Society (down 0.5% to 4.5%).

One other factor that could have played a key role in the Bank of England’s decision was the weakness of the pound against the Euro and the dollar. Despite some recent minor gains, financial experts believe that a larger interest rate would have left the pound valued at an even lower level against these currencies.