Welcome...kkk. to Buyabetterhome fgdfhgdfgdfgdfgdfgdf

Welcome...kkk. to Buyabetterhome fgdfhgdfgdfgdfgdfgdf

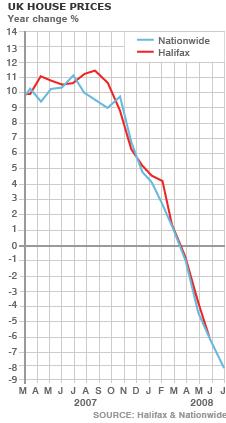

With the downward trend in UK house prices seemingly well established, the threat of negative equity looms large for many. An estimation for this figure, one year from now, has been placed at 1.7m home owners according to a predicted figure of house prices falling by a further 17% in the coming year. This figure has come from the credit ratings agency, Standard & Poors (S&P) who estimate that 14% of all mortgage holders will be in negative equity one year from now. S&P, who specialize in assessing the credit worthiness of organisations trying to raise money by issuing bonds, looked into a sample of 2 million outstanding mortgages and established that the average borrower has a loan worth 54% of their propertys value. Around 70,000 homeowners (0.6% of all UK borrowers) are already in negative equity.

The type of borrowers that S&P believe are most at risk from negative equity are those who have secured loans to be landlords in the buy-to-let market and sub-prime borrowers and lenders who have poor or non-existent credit records, who managed to get loans before the mortgage companies tightened their terms and conditions and stopped lending to that sector of the market. S&P are not the only agency predicting the rise of negative equity; in June, the investment bank Morgan Stanley said that two million households were at risk if house prices fell by 20% by 2010.

Â

These gloomy predictions about negative equity came just before the Nationwide announced its biggest annual fall in house prices since its records began in 1991. The annual decline of 8.1% was confirmed after the building society cited a 1.7% drop for July, bringing the average house price down to £169,316 - £15,000 less than the same month in the previous year. The latest fall has been blamed on sellers being reluctant to accept lower offers and the lack of availability of mortgages. Commenting on the figures, Fionnuala Earley, the Nationwides Chief Economist said: "The weakening economy and poor housing market sentiment do not suggest that the market will recover quickly."

It's already common knowledge that house builders are struggling in the current market but builders now expect the number of new houses built this year will be the lowest since 1924. The Home Builders Federation (HBF), who represent 80% of the house building industry in England and Wales, believes that government action is needed to help stave off more job cuts in the industry. They are suggesting measures such as a stamp duty holiday and tax relief for first time buyers.

Fortunately, the Nationwide report was not all doom and gloom. It said that swap rates, the driver of mortgage rates, had fallen slightly and leading to lower costs in some new fixed rate mortgage deals. The building society also stated that if oil prices continue to fall, then it could be a precursor of interest rate cuts by the Bank of England. The National Housing Federation was also buoyant, saying that it expects house prices to rise by 25% by 2013.

bbc.co.uk

(Image courtesy of bloomberg.com

and thesun.co.uk)