Welcome...kkk. toOur Latest Articles fgdfhgdfgdfgdfgdfgdf

Welcome...kkk. toOur Latest Articles fgdfhgdfgdfgdfgdfgdf

5. Housing supply continues to grow far too slowly to meet increasing demand. Simple economic reasoning suggests that when goods are scare, prices go up.

Date |

Rate (%) |

04/07/88 |

10 |

18/07/88 |

10.5 |

18/08/88 |

11 |

25/08/88 |

12 |

25/11/88 |

13 |

24/05/89 |

14 |

05/10/89 |

15 |

Bank of England base rate, July 1988 to October 1989 (Source: Bloomberg)

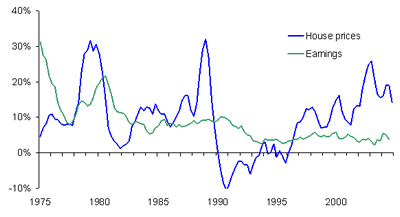

Comparison of Earnings to Average House Price From 1975, clearly showing the crash around 1990