Welcome...kkk. to Buyabetterhome fgdfhgdfgdfgdfgdfgdf

Welcome...kkk. to Buyabetterhome fgdfhgdfgdfgdfgdfgdf

So just how worried should homeowners be by these statements? Well, the answer to that question currently depends on which end of the ladder you're on. The Hometrack figures reported the sharpest drop in value at the very top of the market in prime central London at 0.5%. Further above-average drops were reported in South London (0.4%) and Oxfordshire and Cambridgeshire (0.3%). In further indications of a slowdown, Hometrack found that the number of buyers registering with agents had fallen by 6.4% and the number of sales agreed went down by 4.8% last month.

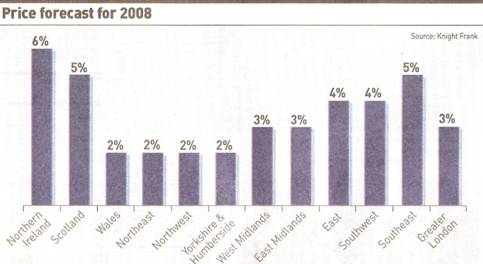

Despite the forecasts of doom from some quarters, there are many other sources that predict a much gentler landing. Many commentators from the research departments of the country's leading estate agents forecast moderate rises next year. For example, Liam Bailey, head of research at Knight Frank, expects prices to rise by an average of 3% next year (see table below). This research is based on the underlying fundamentals of the country's economy; inflation and unemployment remain low coupled with a general shortage of housing. Add to this the fact that the next move in interest rates is much more likely to be down, rather than up.

Although rises in property prices are predicted for next year, market activity is forecast to go down, with 12% fewer houses changing hands. This figure has been envisaged with buyers, aware of the slowdown in the market, demanding reductions and vendors (who don't have to sell) holding firm, leading to something of a stalemate. Bailey sums it up nicely with the words of reason; "more than ever, the market is on a knife-edge, but price falls don't equal a market crash."

Although rises in property prices are predicted for next year, market activity is forecast to go down, with 12% fewer houses changing hands. This figure has been envisaged with buyers, aware of the slowdown in the market, demanding reductions and vendors (who don't have to sell) holding firm, leading to something of a stalemate. Bailey sums it up nicely with the words of reason; "more than ever, the market is on a knife-edge, but price falls don't equal a market crash."